Bookkeeping is the backbone of any healthy business — but for many entrepreneurs, it’s a task that gets pushed to the bottom of the list. Whether you’re running a solo operation or managing a growing team, solid small business bookkeeping practices can help you stay compliant, improve cash flow, and make smarter financial decisions.

In this guide, we’ll break down exactly what small business bookkeeping involves, the tools you can use, and how to keep your records clean without drowning in spreadsheets.

Table of Contents

- What Is Small Business Bookkeeping?

- Bookkeeping vs. Accounting: What’s the Difference?

- What Does Small Business Bookkeeping Include?

- Top Bookkeeping Methods for Small Businesses

- Top Bookkeeping Tools for Small Business

- How to Set Up Small Business Bookkeeping (Step-by-Step)

- 🔄 What Is a Bookkeeping System?

- Common Small Business Bookkeeping Mistakes

- When to Hire a Bookkeeper

- 📊 Small Business Bookkeeping Statistics (2025)

- Conclusion: Make Bookkeeping a Strength, Not a Stress

What Is Small Business Bookkeeping?

Small business bookkeeping is the process of tracking your company’s financial transactions — income, expenses, payroll, invoices, and more — to keep your books organized and accurate.

This isn’t just paperwork. Bookkeeping helps you:

- Stay compliant with tax laws

- Understand where your money’s going

- Prepare financial statements

- Make better budgeting and hiring decisions

- Avoid surprises when tax season hits

Bookkeeping vs. Accounting: What’s the Difference?

While the terms are often used interchangeably, bookkeeping and accounting are different jobs:

- Bookkeeping: The daily process of recording transactions, reconciling bank accounts, and organizing receipts.

- Accounting: A higher-level process of analyzing, interpreting, and reporting on your financial data (typically done by a CPA or accountant).

For small businesses, good bookkeeping lays the groundwork for accurate accounting.

What Does Small Business Bookkeeping Include?

Here are the essential tasks that fall under small business bookkeeping:

1. Tracking Income and Expenses

Record every sale and every business expense, no matter how small. This keeps your profit and loss statement accurate.

2. Managing Invoices and Payments

Track what clients owe you and what you owe suppliers. Send reminders for late payments and monitor accounts receivable/payable.

3. Reconciling Bank Statements

Compare your bank statements to your internal records monthly to spot errors or fraud.

4. Recording Payroll

Keep track of employee wages, benefits, taxes, and other deductions accurately.

5. Categorizing Transactions

Use consistent categories for spending (office supplies, travel, marketing, etc.) so you can generate clean reports and prep for taxes easily.

Top Bookkeeping Methods for Small Businesses

1. Cash Basis vs. Accrual Basis

- Cash basis: Record income/expenses when money changes hands. Simpler, and good for smaller businesses.

- Accrual basis: Record income/expenses when they’re earned or incurred, regardless of payment timing. Required once your business hits a certain size or takes on investors.

2. DIY Bookkeeping

You can manage your own books using spreadsheets or accounting software if you’re a solopreneur or just starting out. It’s cost-effective but requires discipline and regular time investment.

3. Hiring a Bookkeeper

Outsourcing bookkeeping saves time and increases accuracy. You can hire part-time, full-time, or use a virtual bookkeeping service.

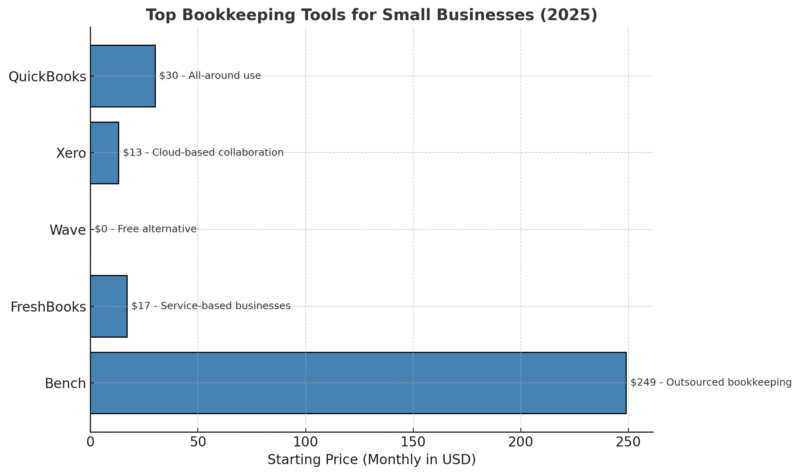

Top Bookkeeping Tools for Small Business

Here are the top platforms used for small business bookkeeping in 2025:

| Tool | Best For | Starting Price | Features |

|---|---|---|---|

| QuickBooks | All-around use | $30/month | Invoicing, payroll, bank sync |

| Xero | Cloud-based collaboration | $13/month | Multi-user, mobile access |

| Wave | Free alternative | $0 | Invoicing, reports, bank sync |

| FreshBooks | Service-based businesses | $17/month | Time tracking, client billing |

| Bench | Fully outsourced bookkeeping | $249/month | Dedicated team + monthly reports |

How to Set Up Small Business Bookkeeping (Step-by-Step)

- Open a separate business bank account

- Choose your bookkeeping method (cash or accrual)

- Select software or hire a professional

- Create a chart of accounts

- Track all income and expenses

- Set a regular schedule (weekly or monthly)

- Reconcile accounts and generate reports

- Store receipts and keep tax records for at least 3 years

🔄 What Is a Bookkeeping System?

A bookkeeping system is the combination of tools and methods you use to record, categorize, and organize your business’s financial activity. This can range from a simple spreadsheet to a robust cloud-based platform with automatic syncing and reporting.

Types of Bookkeeping Systems

- Manual (paper or spreadsheet)

- Software-based (like QuickBooks, Xero)

- Outsourced (monthly service like Bench or in-house pro)

Having a reliable bookkeeping system is essential if you want to scale, seek funding, or sleep better at night knowing your numbers are accurate and up-to-date.

Common Small Business Bookkeeping Mistakes

Avoid these pitfalls:

- Mixing personal and business finances

- Falling behind on reconciling transactions

- Not categorizing expenses properly

- Skipping tax deductions due to poor records

- Waiting until year-end to clean up your books

When to Hire a Bookkeeper

Consider hiring help if:

- You’re spending more time on books than on business

- You’re preparing for tax season and feel overwhelmed

- You want monthly reports but don’t know where to start

- You’ve been audited before or want to avoid red flags

📊 Small Business Bookkeeping Statistics (2025)

- 60% of small business owners feel they aren’t knowledgeable about accounting or finance

- 82% of small businesses fail due to poor cash flow management and bookkeeping practices

- 40% of small businesses incur tax penalties because of inaccurate or late filings

- 70% of small business owners handle bookkeeping themselves — often without formal training

- 75% of business owners who outsource bookkeeping report better financial clarity and fewer tax issues

- QuickBooks is the most used accounting software, with over 5 million small business users globally

- Businesses that use professional bookkeeping services are 30% more likely to survive beyond 5 years

Conclusion: Make Bookkeeping a Strength, Not a Stress

You don’t need to become a financial expert to manage your business, but you do need a reliable bookkeeping process. With the right system, software, or support, small business bookkeeping becomes a smart investment, not just a chore at tax time.

Start simple. Stay consistent. And don’t hesitate to get help when it starts getting in the way of your growth.

Andrej Fedek is the creator and the one-person owner of two blogs: InterCool Studio and CareersMomentum. As an experienced marketer, he is driven by turning leads into customers with White Hat SEO techniques. Besides being a boss, he is a real team player with a great sense of equality.