A payment gateway acts as an intermediary between a merchant and a bank to facilitate online financial transactions. With the rise of ecommerce, payment gateways have become an essential component for online businesses to accept payments. Creating your own payment gateway in 2024 can help you reduce dependency on third-party providers, have more control, and even monetize it.

Table of Contents

- Overview of Steps to Build a Payment Gateway

- Obtain Licensing and Certifications

- Partnering with Banks and Payment Processors

- Building a Transaction Processing Engine

- How to Build a Payment Gateway: Secure Infrastructure and Fraud Prevention

- Streamlined API and Platform Integrations

- How to Make a Payment Gateway: Administrative Portals and Reporting

- Rigorous Testing and Gradual Rollout

- Conclusion

Overview of Steps to Build a Payment Gateway

Here is a high-level overview of what’s involved in building a payment gateway from scratch:

- Obtain licensing and adhere to compliance guidelines

- Partner with a bank and payment processor

- Build a transaction processing engine

- Integrate data security and fraud prevention measures

- Create seamless API integrations

- Develop administrative portals and reporting

- Rigorously test before launch

While the process does require substantial investment and expertise, the long-term benefits from payment gateway development with Mangosoft make it worthwhile for serious entrepreneurs in the ecommerce space. Let’s look at each of these steps in more detail.

Obtain Licensing and Certifications

Depending on where you intend to operate, specific licenses or registrations may be mandatory to create a payment gateway and run it legally. These compliance requirements ensure consumer safety and data security standards.

Some of the common compliance needs include:

PCI DSS Compliance

The Payment Card Industry Data Security Standard is a set of guidelines for storing, processing, and transmitting credit card data. Handling financial information requires adherence to best practices for encryption, firewalls, access controls and more. Depending on transaction volume, different levels of PCI compliance may be necessary.

AML and KYC Protocols

To prevent fraud and money laundering, you’ll likely need to verify merchant identities by collecting documents and bank statements and conducting background checks. Factors like transaction volume and jurisdiction determine the exact Anti-Money Laundering and Know Your Customer norms to be followed. While some users might seek the anonymity offered by a no KYC crypto exchange, businesses must still adhere to regulatory standards to ensure secure and compliant transactions.

Data Protection and Privacy

Regional regulations around data privacy also apply when building a payment gateway. For instance, in the EU, compliance with GDPR norms of data handling is mandatory or hefty fines can be levied.

Ideally, it’s best to consult specialized legal, finance and security experts right from the planning phase to ensure all requisite licenses and technology protocols are in place. This upfront investment goes a long way in preventing regulatory or audit troubles later.

Partnering with Banks and Payment Processors

A payment gateway needs to be backed by banking infrastructure actually to transfer funds between parties. You’ll need to partner with one or more financial institutions and payment technology companies for:

- Bank Accounts: To receive and hold client funds securely in escrow before disbursal

- Merchant Accounts: These specialized accounts let you accept credit/debit payments on behalf of businesses

- Payment Processor: Acts as the bridge between your gateway, issuing bank and card network (Visa, MasterCard, etc.) to enable real-time card transactions. Or you can learn how to create a payment processor and develop your own.

For starters, building relationships with banks and processors that already provide services to existing gateways can help expedite integration. Additionally, ensure that your checkout payment process is seamless and efficient to enhance customer satisfaction and reduce cart abandonment. Over time, as your business scales, you can diversify by adding more providers.

The partnership terms, pricing and capabilities offered will be key criteria for selection. Make sure to conduct in-depth due diligence across factors like technology, security, scalability, customer support levels, dispute resolution and more before finalizing partnerships.

Building a Transaction Processing Engine

This is the technology backbone that executes the passage of funds between customers and merchants through the gateway. Here are its key components:

Payment APIs

Seamless application programming interfaces (APIs) have to be built to connect the payment gateway with ecommerce platforms, accounting software, billing systems and other external services.

Support for protocols like REST, SOAP, JSON, and XML is crucial to integrate easily across diverse systems.

Rigorous documentation and sandbox testing capabilities also need to be provided for developers integrating your gateway to let them know how to create a payment processor in the right way.

Merchant Accounts Engine

The merchant accounts subsystem handles setting up merchant profiles, collecting underwriting documentation, providing virtual terminal access, and managing subscriptions and fees.

Automated workflows for new sign-ups, identity verification, underwriting approval process, etc., have to be engineered for scale.

Payment Processing Engine

This subsystem executes the real-time routing and approval of transactions between customers, merchants and banking partners through a secure channel.

It handles capturing payment details, encrypting sensitive data, getting authorization from the issuing bank, confirming deposits, triggering disbursals and settlement into merchant accounts.

Managing retries, transaction routing logic, reconciliation and exception handling are key.

Reporting and Reconciliation

Transaction dashboards, reports for bookkeeping, settlement statements, payment summaries and other business intelligence functionality are needed.

Reconciliation reports must match every payment to a deposited amount, with an associated fee and payout record. Rigorous accounting controls are vital.

By mapping workflows, anticipating load, architecting redundancies and building recoverability, you can create a smoothly functioning payments engine.

How to Build a Payment Gateway: Secure Infrastructure and Fraud Prevention

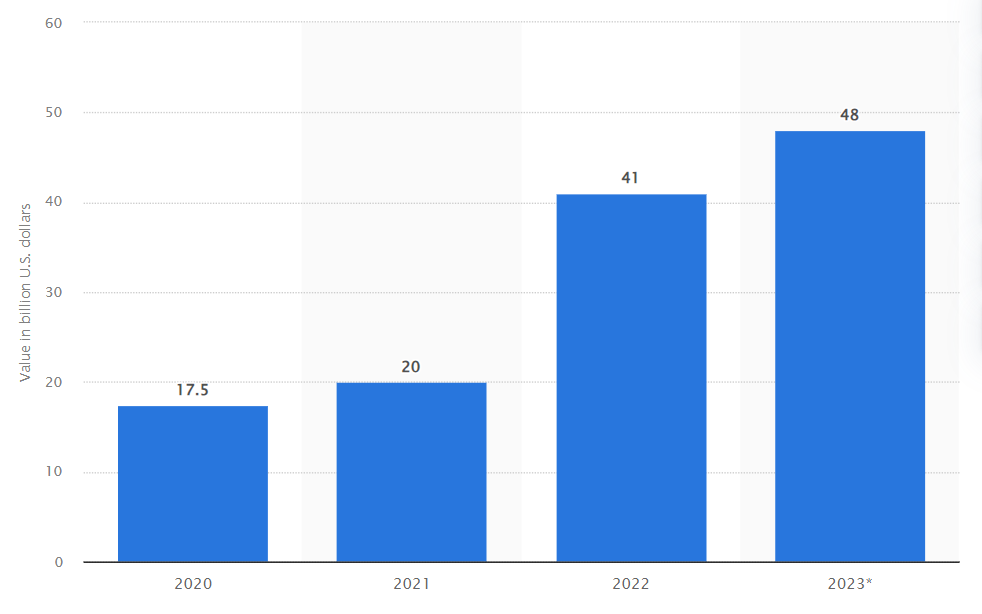

According to estimates, the total amount of money lost to online payment fraud in global ecommerce in 2022 was $41 billion, a 105% increase from the year before. By the end of 2023, this amount should have increased to $48 billion.

With fintech handling sensitive consumer data and money, security has to be the number one priority while creating a payment gateway right from the start. Some aspects to address:

Achieve PCI DSS Compliance

Implementing protocols like mandatory SSL encryption for data transmission, tokenization to avoid storing raw card details, multi-factor authentication for logins, physical data security controls on servers, etc., helps achieve PCI compliance and bolster security.

Address Fraud Risks

Actively watch out for suspicious patterns in transactions, inconsistencies in user behavior, signs of malware infections and other signals to catch fraud. Anomaly detection algorithms and cybersecurity protections have to be built in.

Allowing merchants to set custom rules and leverage capabilities like address verification systems, card verification values, and 3D secure authentication with buyer passwords also helps counter fraud.

Prioritize Uptime and Reliability

Even minor downtime can cause massive disruption and revenue loss for dependent merchants. Ensure high availability across transaction processing and authentication layers by incorporating redundancy from the ground up through multiple data centers failover systems.

Secure Code and Regular Audits

Standard practices like code reviews, penetration testing, security audits and bug bounty programs are a must to identify vulnerabilities or gaps across infrastructure, applications, partner connections, etc. Continual improvements on this front vastly boost reliability for clients relying on your gateway.

Over time, as engineering matures, you can also get certified against standards like ISO 27001 for information security management.

Streamlined API and Platform Integrations

The usefulness of a payment gateway is ultimately determined by how easily it allows merchants to collect payments online.

Smoothing out this integration experience from the buyer’s checkout to the merchant’s order management and inventory accounting is key.

Here are some ways to enable frictionless experiences when you make a payment gateway:

Offer SDKs, Libraries and Code Samples

Have readymade code snippets, libraries and SDKs in diverse languages and frameworks like PHP, JavaScript, Java, Ruby, and Python so developers can quickly integrate without starting from scratch.

Extensive Documentation

Thorough technical documentation on authentication logic, API parameters, testing checklist, troubleshooting tips, and sample code goes a long way in easing developer adoption. Make sure to keep it updated as APIs evolve.

Facilitate Platform Connections

Many ecommerce and accounting platforms like WooCommerce, Shopify, BigCommerce, QuickBooks already have vast developer ecosystems. Building plugins and extensions compatible with their systems simplifies integration.

Dashboard for Testing and Monitoring

A developer dashboard that allows instantly generating test API keys, simulating transactions, inspecting logs, tracking API usage metrics, etc., is invaluable for merchants trying out your gateway.

The easier you make it for merchants to integrate and manage payments from within their existing systems, the more likely they are to adopt your FinTech product when you finally create a payment gateway.

How to Make a Payment Gateway: Administrative Portals and Reporting

While the underlying technology makes card transactions possible, you still need interfaces to manage operations, assist merchants, and track the business.

Some portals and reporting required:

Merchant Portal

A web interface for managing account settings, viewing statements and transaction histories, handling refunds, reconciling payments and getting support.

Partner Portals

To manage relationships with financial institutions, processors, and sales channels that bring in merchants.

Business Intelligence Platform

Reporting on operational metrics like payment volumes, merchant signup trends, usage of features, referrals, disputes logged and resolved, uptime stats and other KPIs essential for business decisions.

Internal Tools

Custom interfaces for your fraud analysts, dispute resolution teams, support agents, and other internal departments that manage the payment gateway.

By centralizing complex back-office functions into intuitive portals, you ease operations for everyone, ranging from small merchants to internal stakeholder teams.

Rigorous Testing and Gradual Rollout

With financial transactions, even minor software flaws or gaps in operational controls can cascade into mammoth disasters, eroding customer trust.

Hence, extensive testing during payment gateway development and gradual rollout make immense sense despite the pressure to launch fast.

- Start with Friendly User Trials. Initially, allow only select friendly merchants to handle low transaction volumes to get feedback. Rectify issues before expanding access.

- Simulate Peak Loads. Use performance testing tools to mimic transaction spikes during peak seasons. Fine-tune capacity planning before large-scale adoption.

- Red Team Testing. Actively inject failures like servers crashing or networks dropping to assess resilience levels inbuilt into the system.

- Operational Readiness Reviews. Conduct internal audits on functional areas like customer support, dispute resolution, compliance controls, etc., to confirm operational readiness before going live.

With a measured rollout approach, you can build battle-hardened systems and processes for the prime time.

Conclusion

By leveraging a cloud-native technology stack and API-first design, creating your own customizable payment gateway is more feasible than ever in 2024, even for emerging fintech players.

So, how to make my own payment gateway?Collaborating closely with banking and hardware partners continues to be key to bringing a robust, regulatory-compliant solution to the market.

The complex aspect is less about technology and more about navigating relationships with the existing payment value chain.

With the right strategic partnerships and methodical technology execution, new entrants can still innovate niche value propositions and under-served segments despite the dominance of giants like Stripe or PayPal in the mainstream space.

So, if you have ambitions of owning the customer relationship in the payments journey, the time has never been riper to make inroads with your own payment gateway.

Andrej Fedek is the creator and the one-person owner of two blogs: InterCool Studio and CareersMomentum. As an experienced marketer, he is driven by turning leads into customers with White Hat SEO techniques. Besides being a boss, he is a real team player with a great sense of equality.