FintechZoom is a leading financial news and information platform that covers a wide array of topics within the finance industry, including stocks, cryptocurrencies, banking, and fintech. One of the most talked-about stocks featured on FintechZoom is GameStop Corp. (GME), which gained worldwide attention during the unprecedented short squeeze event in early 2021. This article aims to provide a thorough understanding of both FintechZoom and GME stock, detailing their significance, the events surrounding the GME short squeeze, and the broader implications for the financial markets.

Table of Contents

What is FintechZoom?

FintechZoom is an online platform dedicated to delivering the latest financial news, analysis, and insights. It covers various sectors within the finance industry, including:

- Stock Market Updates: Detailed reports on stock market movements, company performances, and investment opportunities.

- Cryptocurrency News: Insights into the latest trends, market analyses, and regulatory updates in the crypto space.

- Banking and Fintech Innovations: Information on new technologies, digital banking solutions, and fintech startups.

- Personal Finance Tips: Guidance on managing personal finances, investing, and retirement planning.

By providing up-to-date and comprehensive financial information, FintechZoom serves as a valuable resource for investors, traders, and financial enthusiasts.

Overview of GameStop (GME) Stock

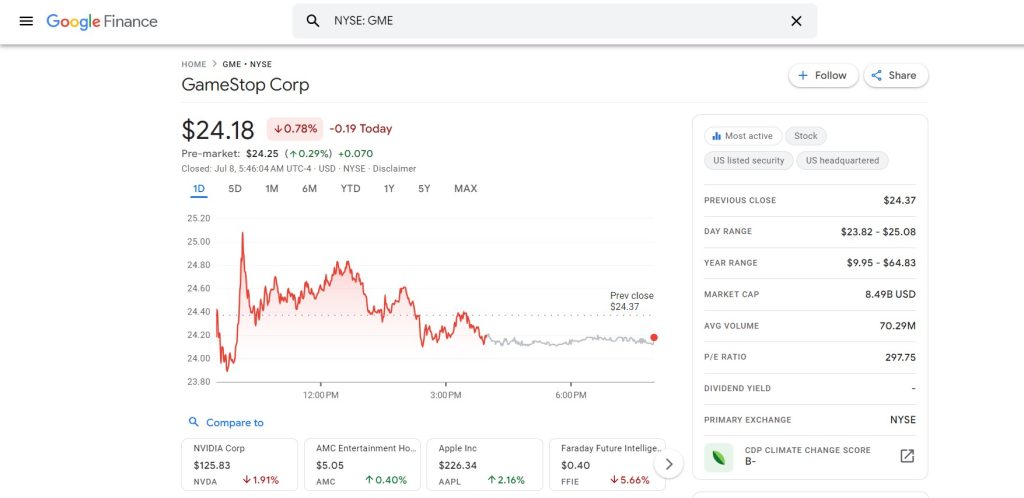

GameStop Corp. is a video game, consumer electronics, and gaming merchandise retailer headquartered in Grapevine, Texas. GME is its stock ticker symbol, and it is publicly traded on the New York Stock Exchange (NYSE). Historically, GameStop operated physical retail stores, but it faced challenges due to the shift towards digital gaming and e-commerce.

The GME Short Squeeze Phenomenon

In early 2021, GME stock became the focal point of a dramatic short squeeze orchestrated by retail investors primarily communicating through the subreddit WallStreetBets. Here’s a breakdown of the events and their significance:

- Background:

- GameStop was heavily shorted by institutional investors, meaning these investors bet against the stock, expecting its price to fall.

- Short selling involves borrowing shares and selling them with the intention of buying them back at a lower price, thus making a profit.

- The Short Squeeze:

- Retail investors noticed the high short interest in GME and began purchasing shares en masse.

- This buying frenzy drove up the stock price, forcing short sellers to cover their positions by buying back shares at higher prices, further fueling the price surge.

- Market Impact:

- GME’s stock price skyrocketed from around $20 in early January 2021 to an all-time high of $483 in late January.

- The event highlighted the power of retail investors and raised questions about market manipulation, the role of social media in trading, and the practices of hedge funds.

Broader Implications of the GME Saga

The GME short squeeze had several significant implications for the financial markets:

- Regulatory Scrutiny: The event prompted regulatory bodies, such as the SEC, to investigate the trading practices and market dynamics that led to the squeeze.

- Market Volatility: The volatility surrounding GME and other “meme stocks” led to increased market instability, affecting other stocks and sectors.

- Retail Investor Empowerment: The success of retail investors in driving up GME’s price underscored their growing influence in the stock market, traditionally dominated by institutional investors.

- Brokerage Platform Responses: Platforms like Robinhood faced backlash for restricting trading in GME and other stocks, leading to debates about fair access to the markets.

Conclusion

The GME stock saga, extensively covered by platforms like FintechZoom, is a landmark event in financial history. It demonstrated the potential of coordinated retail investor actions to challenge institutional players and highlighted the need for ongoing discussions about market regulations and trading practices. FintechZoom continues to provide crucial updates and insights on such events, making it an indispensable resource for anyone interested in the financial markets.

By understanding both FintechZoom and the intricacies of the GME short squeeze, investors can better navigate the complexities of modern finance and stay informed about significant market movements.

Andrej Fedek is the creator and the one-person owner of two blogs: InterCool Studio and CareersMomentum. As an experienced marketer, he is driven by turning leads into customers with White Hat SEO techniques. Besides being a boss, he is a real team player with a great sense of equality.