Picture this: you’ve poured your heart into your business, but scaling feels like climbing sand dunes.

Florida, though, has a hidden network of small business grants Florida designed to help you level up — debt-free.

This isn’t another wish-list of “free money” fantasies. It’s a practical map of where real funds exist, what the state expects in return, and how to stand out when hundreds of others apply.

Small business grants Florida are non-repayable funds offered by state, local, and private programs to help small companies expand or recover.

This article explores where to find them, who qualifies, and how to apply effectively. You’ll see examples of real success stories and get actionable advice on crafting a winning application.

The intent here is definitional — to clarify what these grants are, how they work, and why they matter for Florida entrepreneurs.

Start by pinpointing programs through verified sources like SBA.gov and FloridaJobs.org.

Table of Contents

- What Small Business Grants Actually Are

- Eligibility: Who Qualifies and Why

- Major Grant Opportunities in Florida

- Real-Life Proof

- How to Apply Without Getting Lost in Bureaucracy

- Challenges: What Trips Applicants Most

- Statistics Worth Noting

- Why These Grants Matter More in 2025

- Common Misunderstanding: SBA “Free Money” Myth

- Final Words

What Small Business Grants Actually Are

A business grant is money you don’t repay — but you do earn it through purpose alignment.

Unlike loans, grants carry no interest, yet they demand clear intent, documentation, and accountability.

Most small business grants Florida come from either state agencies or county-level programs meant to spur job creation, technology, sustainability, or local revitalization.

When used strategically, they can replace years of slow organic growth.

Eligibility: Who Qualifies and Why

Florida’s eligibility spectrum is surprisingly broad.

Applicants range from micro-shops and minority-owned startups to export-ready manufacturers.

Preference usually goes to companies that:

- Create or sustain local jobs

- Invest in technology or workforce training

- Contribute to rural or disadvantaged areas

Industries like tourism, agriculture, and emerging tech remain consistent favorites.

Major Grant Opportunities in Florida

| Program | Funding Range | Purpose |

|---|---|---|

| Florida High Tech Corridor | Up to $150,000 | Supports tech startups, R&D, and university-industry collaboration in 23 counties. |

| Miami-Dade Mom & Pop Grant | Up to $5,000 | Helps small local shops upgrade equipment, signage, or storefront design. |

| CareerSource Florida Training Grant | Varies (avg. $25K) | Funds staff upskilling and job creation across industries. |

| Rural Business Development Grant | $10K–$50K | Supports rural projects that increase employment or infrastructure resilience. |

| FDACS Agricultural Grant | Varies | Funds sustainable farming, agri-tech, and food safety innovation statewide. |

Real-Life Proof

A bakery in Miami Gardens once won the Mom & Pop Grant, purchasing new ovens that doubled output within six months.

In Tampa, a boutique design studio used CareerSource training funds to teach digital skills to interns — later hiring two of them full-time.

These stories show that small business grants Florida aren’t abstract; they’re growth catalysts that actually transform day-to-day operations.

How to Apply Without Getting Lost in Bureaucracy

Start by pinpointing programs through verified sources like SBA.gov and FloridaJobs.org.

Both aggregate legitimate opportunities and post updated eligibility calendars.

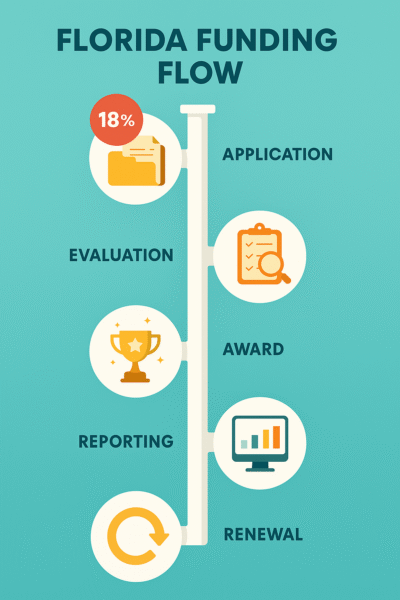

Next, follow this rhythm:

- Define what you’ll use the funds for (specific projects win).

- Gather business financials, licenses, and your EIN.

- Write a concise statement linking your business impact to local economic benefit.

- Submit before deadlines — early applicants often get reviewed first.

And here’s the often-missed trick: mention measurable outcomes — number of employees trained, new jobs created, or export revenue potential.

Challenges: What Trips Applicants Most

Many business owners fail not because they lack worthiness — but clarity.

Applications filled with jargon or missing data collapse under scrutiny.

Another mistake? Assuming one generic proposal fits all.

Every small business grants Florida program has unique metrics — copy-pasting from one grant to another signals laziness to reviewers.

Statistics Worth Noting

According to the Florida Department of Commerce, over $91 million in small business incentives were distributed in 2024.

Meanwhile, minority-owned enterprises made up 42% of state grant recipients — a significant rise from pre-pandemic numbers.

This proves that persistence, storytelling, and precision can outshine even larger competitors.

Why These Grants Matter More in 2025

As inflation pushes traditional lending costs higher, free capital becomes the ultimate advantage.

Florida’s business climate is expanding fast — but competition grows with it.

The state’s goal for 2025–2026 focuses on innovation ecosystems and digital readiness, making now the perfect window to secure your first or next grant.

Common Misunderstanding: SBA “Free Money” Myth

The SBA doesn’t directly hand out startup grants.

Instead, it channels funds to community lenders and resource partners.

So, when you search small business grants Florida, ensure the source is verified — either government (.gov) or a regional SBDC partner.

Final Words

Building a business in Florida means building under sunlight — but even sunshine needs capital to grow crops.

Grants offer that nourishment, minus the debt clouds that loans bring.

Start today. Check your eligibility, draft your plan, and take one step toward your next funding win.

It’s not luck — it’s preparation meeting opportunity.

Andrej Fedek is the creator and the one-person owner of two blogs: InterCool Studio and CareersMomentum. As an experienced marketer, he is driven by turning leads into customers with White Hat SEO techniques. Besides being a boss, he is a real team player with a great sense of equality.