The European financial landscape has significantly transformed over the past decade, with electronic payment systems taking center stage. In the first half of 2024, the euro area experienced a 7.4% increase in non-cash payment transactions, totaling 72.1 billion. Card payments dominated, accounting for 56% of these transactions, highlighting the continent’s shift towards digital financial services.

This surge is not merely a trend but a reflection of the growing consumer preference for convenience, speed, and security in financial transactions. The proliferation of smartphones and the internet has further accelerated this shift, enabling consumers to access financial services at their fingertips.

Table of Contents

Meeting the Demand for Digital Transactions

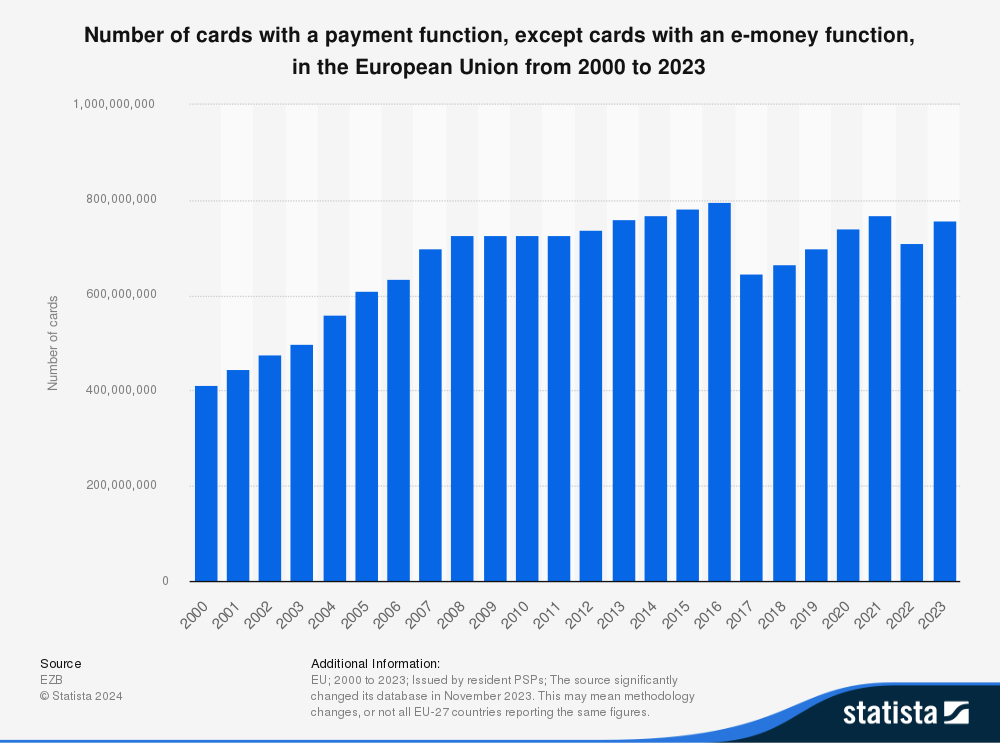

The demand for payment cards has seen a substantial rise. By mid-2024, the number of cards with a payment function in the euro area increased by 4.4% to 720.6 million, averaging two per inhabitant.

The demand for payment cards has substantially risen in recent years, reflecting broader trends in consumer behavior and technological advancements in the financial sector. By mid-2024, the number of cards with a payment function in the euro area increased by 4.4% to 720.6 million, averaging two per inhabitant.

European licensed electronic payment system benefits

Card Issuing:

Walletto provides comprehensive Visa and Mastercard card issuance services tailored to business needs. Physical and virtual cards ensure high security, efficient management, and seamless integration into payment systems. All cards support digital wallets such as Apple Pay and Google Pay, enabling fast and secure transactions. Reliable and flexible solutions from Walletto help optimize payment management processes and enhance transaction convenience.

Acquiring Services:

Walletto delivers reliable and efficient solutions for accepting online payments. Integration with Visa, Mastercard, Apple Pay, and Google Pay ensures fast and secure transactions. Advanced acquiring technology helps optimize payment processes and enhance transaction convenience for businesses. Thanks to the WooCommerce payment plugin, any WordPress online store can be transformed into a powerful e-commerce platform equipped with a wide range of features for seamless online sales.

Business Accounts:

Walletto offers access to a European IBAN account for businesses, featuring personalized support, efficient management, and reliable financial transactions, all while ensuring full compliance with stringent security standards. Facilitate seamless SEPA & SWIFT payments through Walletto’s i-banking or API integration, enabling smooth transactions for a wide range of business types and diverse needs. Process euro Mass Payments, enabling fast and efficient transfers to multiple recipients for high-volume payment processing.

Partnering with a trusted financial services provider ensures secure and compliant payment solutions tailored to your needs.

Seamless and secure transactions

The need for seamless and secure transactions drives this remarkable growth. Consumers increasingly favor card payments over cash due to their convenience and security. Payment cards eliminate the need to carry cash, reducing the risk of theft and loss. Moreover, transactions made with payment cards are often protected by robust security measures such as EMV chips, PIN codes, and two-factor authentication, providing consumers with greater peace of mind.

One key factor contributing to this surge in payment card usage is the widespread adoption of contactless technology. Contactless payment cards enable users to complete transactions quickly by tapping their card on a payment terminal without needing physical contact or entering a PIN for small amounts.

Contactless technology

The integration of contactless technology has made card payments even more appealing, allowing for quick transactions without the need for physical contact. This convenience has led to a significant shift in consumer preferences, with many opting for card payments over traditional cash transactions. The ease of use and quick processing times associated with contactless payments have made them the preferred choice for everyday purchases such as groceries, public transportation, and dining out.

E-money transactions

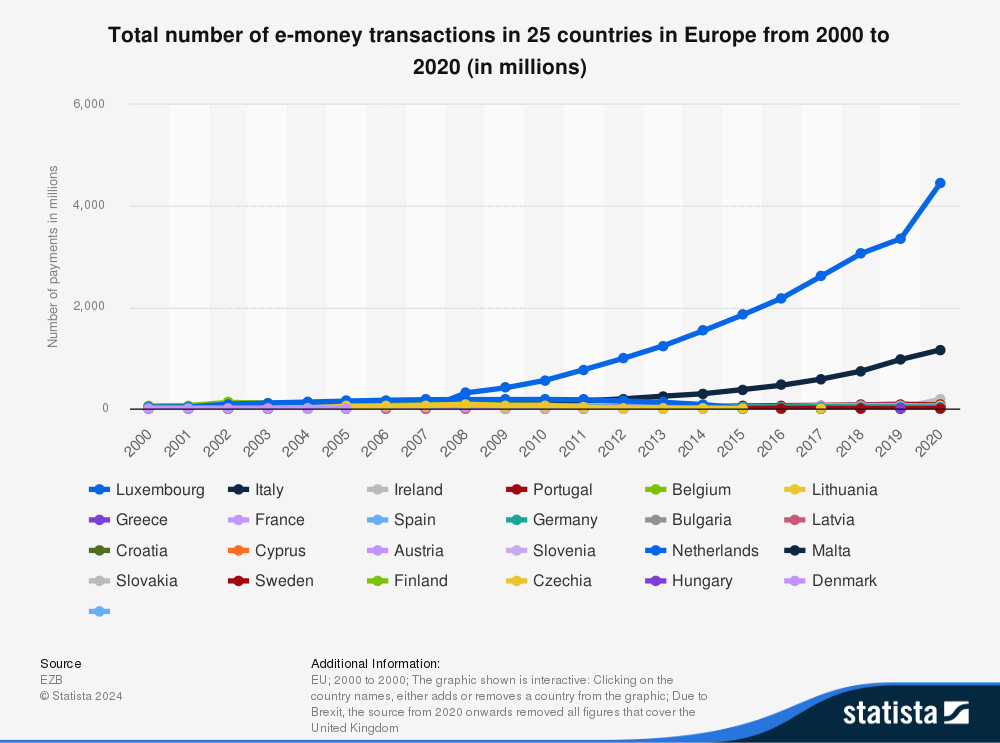

According to the statistics, e-money transactions increased significantly across 25 European countries from 2000 to 2020, with Luxembourg leading the trend, especially after 2015. The data highlights the rapid adoption of digital payment methods, driven by advancements in financial technology and growing consumer preference for cashless transactions.

E-commerce and online shopping

Furthermore, the rise in e-commerce and online shopping has significantly contributed to the increased demand for payment cards. Secure and reliable payment methods have become paramount as more consumers shop online. Payment cards provide a convenient solution for online transactions, enabling consumers to purchase from the comfort of their homes. Additionally, many payment cards offer benefits such as cashback rewards, discounts, and fraud protection, further incentivizing their use.

The financial industry has also played a crucial role in promoting the use of payment cards. Banks and financial institutions have introduced various initiatives to encourage card usage, such as offering attractive sign-up bonuses, reward programs, and zero annual fees. Additionally, advancements in digital banking and mobile payment solutions have made it easier for consumers. ( Managing payment cards, tracking expenses, and making payments using their smartphones have become easier. )

Based on the infographic from Statista, the steady growth in the number of payment cards issued in the European Union from 2000 to 2023 peaked around 2016-2017. Despite slight fluctuations in recent years, the overall trend reflects the widespread adoption of card-based payments across the region.

Licensed payment service providers (PSPs) are pivotal in facilitating seamless and secure transactions. These entities, authorized under frameworks such as the European Union’s Payment Services Directive (PSD2), are entrusted with handling payment services ranging from credit transfers to direct debits, ensuring compliance with stringent regulatory standards.

Digitalization of Financial Services

Another significant factor driving the growth of payment card adoption is the increasing digitalization of financial services. The development of digital wallets, mobile payment apps, and fintech solutions has made it more convenient for consumers to use payment cards. Digital wallets such as Apple Pay and Google Pay allow users to securely store payment card information on their devices and effortlessly make contactless payments. This integration of payment cards with digital platforms has further enhanced their appeal and usage.

In addition to consumer-driven factors, regulatory initiatives, and industry standards have also contributed to the growth of payment card usage. Regulatory bodies have implemented measures to ensure the security and reliability of payment card transactions, fostering trust among consumers. Industry standards such as the Payment Card Industry Data Security Standard (PCI DSS) mandate stringent security practices for handling cardholder data, further enhancing the safety of payment card transactions.

The growth in payment card usage also reflects broader economic trends, such as increasing urbanization, rising disposable incomes, and the growing middle class. As more people move to urban areas and experience higher income levels, their spending patterns shift towards more convenient and secure payment methods, such as payment cards.

Final Words

The substantial rise in the demand for payment cards in the euro area is driven by technological advancements, changing consumer preferences, e-commerce, financial industry initiatives, digitalization of financial services, and regulatory measures. As the European financial landscape continues to evolve, the use of payment cards is expected to grow even further, shaping the future of transactions and payments in the region.

Andrej Fedek is the creator and the one-person owner of two blogs: InterCool Studio and CareersMomentum. As an experienced marketer, he is driven by turning leads into customers with White Hat SEO techniques. Besides being a boss, he is a real team player with a great sense of equality.