Starting and growing a small business can be a rewarding journey, but it also comes with significant financial challenges. For many entrepreneurs, securing adequate funding is a critical first step. Small business loans for women offer a practical solution by providing the necessary capital to help businesses get started or expand. In recent years, there has been a growing emphasis on providing financial support to women-owned businesses, which play a vital role in the economy.

This article will examine the various types of small business loans, the options available to women-owned businesses, and provide tips for navigating the loan application process.

Table of Contents

What Are Small Business Loans?

Small business loans are funds provided by financial institutions to small businesses that need capital for various purposes, such as startup costs, expansion, equipment purchase, or working capital. These loans come in various forms, each designed to meet the unique needs of different types of businesses.

Some common types of Small Business Loans for Women include:

- Term loans: These loans provide a lump sum of money that must be repaid over a specified period, typically with fixed interest rates.

- Lines of credit: A revolving loan that provides businesses with access to a pre-approved amount of capital, which they can draw from as needed.

- SBA loans: These loans are partially guaranteed by the Small Business Administration (SBA) and are typically easier to qualify for than conventional loans. They often come with favorable terms.

- Equipment financing: Used to purchase machinery or equipment, these loans use the purchased equipment as collateral.

- Invoice factoring: This option allows businesses to sell their outstanding invoices to a lender at a discount in exchange for immediate cash flow.

- Microloans: Targeted at very small businesses or startups, these loans typically offer smaller amounts and shorter repayment terms.

Each loan type has its benefits and drawbacks, and the right option depends on the specific needs of the business.

Why Small Business Loans Matter

Small business loans are essential for several reasons. First, they provide immediate access to capital, which can help businesses launch, sustain operations, or expand without having to wait to accumulate sufficient savings. Loans can also help businesses manage their cash flow, cover unexpected expenses, or capitalize on new opportunities. Without this financial support, many small businesses would struggle to survive, especially in their early stages.

For women-owned businesses, access to loans can be critical. Women have historically faced more challenges when it comes to securing business financing. According to a study by the National Women’s Business Council, women are less likely than men to receive loans from traditional financial institutions. They are more likely to rely on personal savings or credit cards to finance their businesses. As a result, ensuring women have equal access to business loans is crucial for leveling the playing field.

Small Business Loans for Women-Owned Businesses

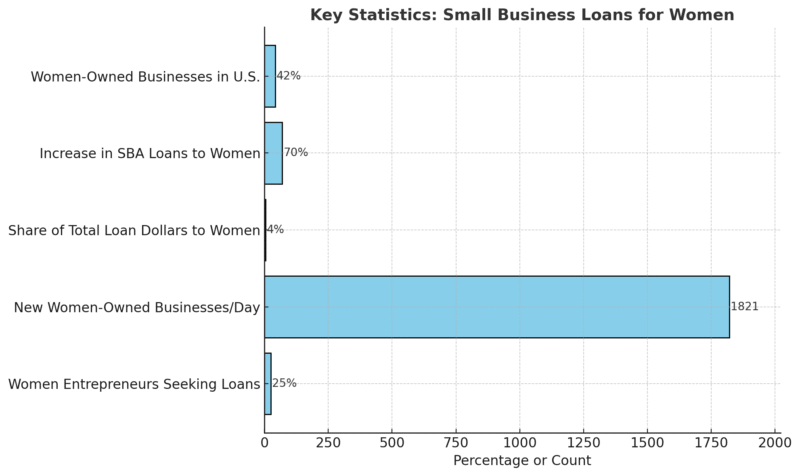

The rise of women-owned businesses is one of the most significant trends in the entrepreneurial world. Women now own more than 42% of all small businesses in the U.S., and they continue to contribute significantly to job creation and economic growth. However, despite this impressive growth, many women still face obstacles when seeking business loans. Women entrepreneurs with poor credit may also struggle with accessing traditional loans. In such cases, loans for poor credit can offer a potential lifeline to help manage financial gaps.

Recognizing this, several financial institutions, nonprofit organizations, and government programs have developed loan products specifically designed to meet the needs of women entrepreneurs. These loans typically offer more flexible terms, lower interest rates, or reduced collateral requirements to make financing more accessible to women-owned businesses.

Comparison Table of Loan Options

| Loan Type | Best For | Amount Range | Credit Needed | Application Time |

|---|---|---|---|---|

| SBA 7(a) Loan | Growth, working capital | Up to $5 million | Good to great | 1–2 months |

| SBA Microloan | Startups, small needs | Up to $50,000 | Fair+ | 2–4 weeks |

| CDFI Loan | Underserved, lower credit scores | Varies | Flexible | Varies |

| Grameen America | Very small businesses, low-income | $500–$2,000 | None required | Fast |

| Online Lender (e.g., OnDeck) | Quick capital, short-term needs | Up to $250,000 | Fair+ | Same day–1 week |

1. SBA Loans for Women

The U.S. Small Business Administration (SBA) offers several loan programs that are open to all small business owners but can be especially helpful for women. The SBA 7(a) loan, for instance, is the most popular, offering up to $5 million in capital with favorable repayment terms. Women-owned businesses can also benefit from the SBA Microloan program, which provides smaller loans of up to $50,000, making it ideal for startups or businesses with modest financing needs.

Example: Maria in Dallas launched a catering business using a $10,000 SBA Microloan. After applying through her local Women’s Business Center, she secured funding in 45 days and used it to buy commercial kitchen equipment.

The U.S. Small Business Administration (SBA) offers several loan programs specifically designed to support women entrepreneurs. These programs aim to provide better access to capital, which has historically been a challenge for women-owned businesses. Among these options, SBA’s 7(a) and 504 loan programs stand out, offering funding for a variety of business needs, including working capital, equipment purchase, and real estate. The SBA has reported significant growth in lending to women entrepreneurs, with SBA-backed loans to women-owned businesses increasing by 70% under recent initiatives.

Additionally, the SBA’s Women’s Business Centers (WBCs) provide tailored training and counseling to help women business owners navigate the complexities of starting and growing their businesses. These centers play a crucial role in connecting women entrepreneurs with the resources they need to succeed, such as loan applications and financial literacy.

The SBA also offers the Women-Owned Small Business (WOSB) certification, which helps women compete for federal contracts, further supporting business growth. These initiatives demonstrate the SBA’s commitment to leveling the playing field for women in business, providing essential financial tools and opportunities to drive economic growth.

Additionally, the SBA offers the Women-Owned Small Business (WOSB) certification program, which helps women entrepreneurs compete for federal contracts, potentially opening up more business opportunities.

Where to apply:

- Visit www.sba.gov and use the Lender Match tool to connect with SBA-approved lenders.

- Reach out to your local SBA District Office or Women’s Business Center (WBC) for assistance.

Additionally, the SBA Women-Owned Small Business (WOSB) certification helps women compete for federal contracts, expanding business opportunities.

2. Community Development Financial Institutions (CDFIs)

CDFIs are nonprofit lenders that focus on providing loans to underserved markets, including women-owned businesses. These organizations typically offer more flexible loan terms and are more willing to work with business owners who may not have a strong credit history. CDFIs also often provide additional support, such as business mentoring and financial education, making them a great resource for women entrepreneurs who may need extra guidance.

Where to apply:

- Use the CDFI Fund search tool on cdfifund.gov to find a nearby CDFI.

- Organizations like Accion Opportunity Fund, LiftFund, and DreamSpring offer loans specifically to women-owned businesses.

3. Grameen America

Grameen America is a nonprofit microfinance organization that focuses on providing loans to women entrepreneurs, particularly those in low-income communities. Since its inception, Grameen America has helped thousands of women launch and grow their businesses by offering microloans, financial training, and support. Loans typically range from $500 to $2,000, making them ideal for businesses that need small amounts of capital to get started.

Where to apply:

- Apply directly at www.grameenamerica.org.

- Applicants must join a local Grameen group and complete orientation before receiving funding.

4. Online Lenders

Online lenders have become increasingly popular in recent years due to their quick approval processes and flexible loan terms. Many online platforms, such as Kabbage, Fundbox, and OnDeck, offer small business loans tailored to the needs of women-owned businesses. While interest rates can vary, these platforms often provide a faster alternative to traditional banks, making them ideal for women who need funding quickly.

Popular platforms include:

- Kabbage

- Fundbox

- OnDeck

- BlueVine

Where to apply:

- Visit the lender’s website to apply directly.

- Be prepared to upload your financial records, tax documents, and business documents online.

Tips for Securing a Small Business Loan

Securing a small business loan can be a challenging process, but preparation and understanding the requirements can make it easier. Here are some tips to help women entrepreneurs successfully navigate the loan application process:

1. Build a Strong Business Plan

A well-developed business plan is essential when applying for a loan. Lenders want to see that you have a clear vision for your business and that you understand how you will generate revenue and repay the loan. Your business plan should include detailed financial projections, an overview of your business model, and a strategy for growth.

2. Improve Your Credit Score

Lenders will consider both your personal and business credit scores when evaluating your loan application. A strong credit score can increase your chances of getting approved for a loan and help you secure better interest rates. If your credit score is less than ideal, consider taking steps to improve it before applying for a loan, such as paying down debt or correcting errors on your credit report.

3. Consider Collateral

Many small business loans require collateral, which could be business assets, personal assets, or even equipment purchased with the loan. Consider what you can offer as collateral and be prepared to discuss this with potential lenders.

4. Explore Alternative Lenders

If traditional banks are not an option, consider alternative lenders such as online lenders, CDFIs, or nonprofit organizations. These institutions often have more flexible lending criteria and may be more willing to work with women entrepreneurs who have less access to capital.

5. Seek Professional Advice

Navigating the loan process can be complex, and seeking advice from a financial advisor or a mentor can be invaluable. Many organizations, such as SCORE and the Women’s Business Centers, offer free mentoring and guidance to women entrepreneurs seeking financing. You can also check the cost of a startup with an SBA loan calculator.

Where and How Women Can Apply for Small Business Loans in the USA

Women entrepreneurs can apply for small business loans through the following avenues:

1. SBA and SBA-Approved Lenders

- Use the SBA Lender Match tool to connect with local lenders.

- Contact your nearest Women’s Business Center for loan preparation help and business coaching.

2. CDFIs

- Find a local CDFI at cdfifund.gov.

- Submit an online application or schedule a consultation to discuss your loan options.

3. Nonprofit Organizations

- Apply through mission-based lenders like Grameen America, Kiva, or LiftFund.

4. Online Loan Platforms

- Visit lender sites like OnDeck.com, Kabbage.com, or Fundbox.com to apply directly.

- Some platforms give instant decisions and same-day funding.

5. Local and State Economic Development Agencies

- Many states offer Small Business Loans for Women through economic development programs and grant initiatives, according to USGrants.org. Check your state’s Department of Commerce or Economic Development website.

Bonus: Steps to Prepare Before Applying for Small Business Loans for Women

Before hitting “submit” on any loan application, take these steps to improve your chances of approval and secure better terms:

1. Gather Required Documents in Advance

Most lenders will require some combination of the following:

- Business plan

- Personal and business tax returns (last 2 years)

- Profit and loss (P&L) statement

- Balance sheet

- Cash flow statement

- Business licenses and registrations

- Articles of incorporation (if applicable)

- Legal contracts (leases, franchise agreements)

- Personal financial statement

Having these documents ready shows professionalism and speeds up the approval process.

2. Register and Structure Your Business Properly

Ensure your business is legally registered (e.g., LLC, Corporation), has an Employer Identification Number (EIN), and maintains a separate business bank account. This boosts your credibility in the eyes of lenders.

3. Open and Use a Business Bank Account

Lenders prefer to see business revenue flowing through a business account, rather than personal accounts. If you haven’t already, open one and start routing your income and expenses through it for at least three to six months.

4. Build Business Credit

If your business is new or has no credit history, start small:

- Open a business credit card and pay it off regularly

- Set up accounts with vendors who report to credit bureaus (e.g., Uline, Quill)

- Keep your credit utilization low

5. Use a Loan Readiness Checklist

A simple checklist helps keep things on track. Here’s a sample you can include or link to:

| Task | Status |

|---|---|

| Write a complete business plan | ✅ |

| Review and improve credit score | ⬜ |

| Gather tax returns and financial statements | ⬜ |

| Compare at least 3 lenders | ⬜ |

| Seek help from a mentor or advisor | ⬜ |

Free Resources for Women Entrepreneurs

These organizations offer no-cost tools, mentoring, and guidance to help with business loan applications:

- SCORE: Free mentoring from business professionals (www.score.org)

- SBA Women’s Business Centers: Training, counseling, and funding prep

- SBDC (Small Business Development Centers): Local advisors who help with loan readiness

- IFundWomen: Offers funding options, grants, and crowdfunding tools for women entrepreneurs

- Kiva: 0% interest microloans up to $15,000 with a crowdfunding twist (www.kiva.org)

Conclusion

Small business loans are a vital tool for entrepreneurs looking to start, grow, or sustain their businesses. For women-owned businesses, in particular, having access to the right financing options can make all the difference. By understanding the available loan options and preparing effectively, women entrepreneurs can overcome financial barriers and succeed in their entrepreneurial endeavors. Whether you’re just starting out or looking to expand, securing the right small business loan can help propel your business to the next level.

Resources: https://www.sba.gov

FAQ

- Can I get a business loan with bad credit?

Yes, many CDFIs and microloan programs offer Small Business Loans for Women with poor credit. You may need to provide collateral or a strong business plan. - Do I need a business plan to apply for a loan?

In most cases, yes, especially with banks or the SBA. Lenders want to understand how you plan to use the funds and how you intend to repay them. - Are there any grants available as an alternative to loans?

Yes. While this article focuses on loans, women entrepreneurs can also explore grants from organizations such as IFundWomen, the Amber Grant, and local economic development offices.

Use an SBA loan calculator (available on sba.gov or most lender websites) to estimate your monthly payments, interest, and total repayment before applying. This helps avoid surprises and ensures the loan is a good fit for your cash flow.

Andrej Fedek is the creator and the one-person owner of two blogs: InterCool Studio and CareersMomentum. As an experienced marketer, he is driven by turning leads into customers with White Hat SEO techniques. Besides being a boss, he is a real team player with a great sense of equality.