Historically, when it came to analog transactions, the dollar has served as a means to extend U.S. political and military influence. However, in today’s world, where digital technology and mobile applications give everyone access to banking services, the dollar is beginning to be associated with the spread of democracy. Not only a select few, but everyone can now use financial services, which is one of the manifestations of democratization. In addition, users are able to choose between different financial platforms that provide access to a wide range of financial instruments. In this article, we present a comparative analysis of two payment systems popular in the US — Cash App and Venmo.

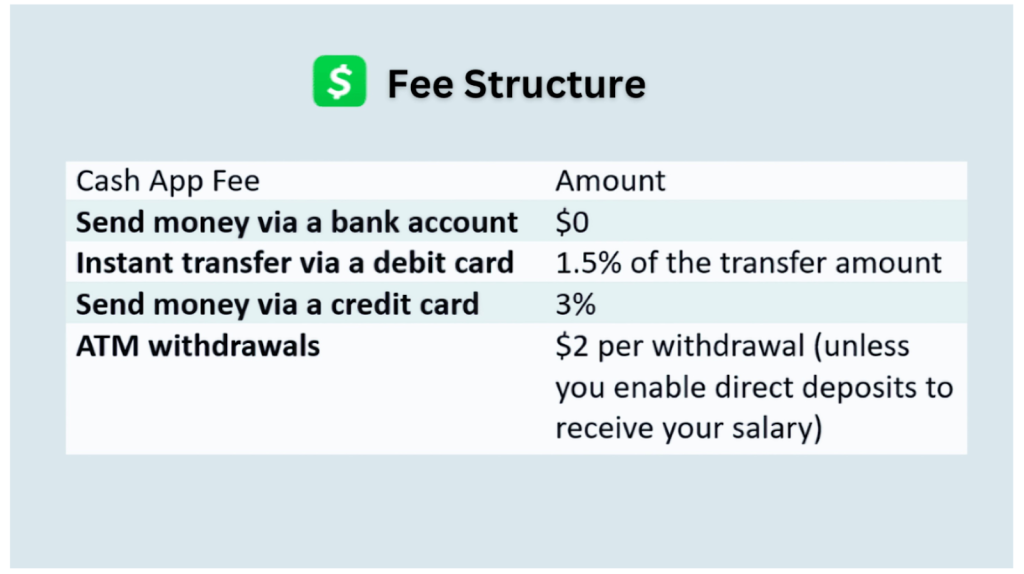

We will look at their advantages and disadvantages, including, for example, how much Cash App charges in fees, so that you can make an informed choice in favor of one of the systems. Additionally, we will explore user experience, security features, and the unique functionalities each platform offers.

Table of Contents

Cash App: Convenience and Cryptocurrencies

Cash App, the brainchild of Block, Inc. (formerly known as Square, Inc.), offers users an exceptionally wide range of financial services that come with benefits:

- The ability to send and receive money instantly is particularly useful for transactions among family members or within small teams. Wondering about the fees Cash App charges for this service? It’s free of charge.

- Free federal and state tax filing. This Cash App Taxes service comes with audit protection and tax refund optimization.

- Get your paychecks, tax refunds and other system payments two days earlier.

- Commission-free investments can be made starting at $1. Speaking of democracy: Cash App allows you to invest in stocks even with a small amount of money, making the investment accessible to a wide range of people, regardless of the size of their capital.

- Commission-free trading — buying, selling, accumulating, — bitcoin (BTC). Cash App has integrated the Lightning Network, a tool for instant and commission-free crypto transactions. This is particularly useful for microtransactions and may encourage wider adoption of bitcoin as a medium of exchange.

A banking service available in the Cash App, such as the ability to obtain a physical debit card — Cash Card, deserves special attention. With the help of this card, you can pay cashless in restaurants and stores, while gaining access to various loyalty programs — promotions and discounts. Moreover, with Cash Card, you can withdraw cash from ATMs. All this is wrapped in a personalized approach to each user, a simple interface and a new level of security of users’ personal data who prefer physical cards to virtual ones. About how Cash App boost get more from Irina Tsymbaliuk on Rates.

Disadvantages of Cash App

It’s only fair to discuss the drawbacks of the Cash App financial platform as well. As the advantage of this platform is focused on US residents, its disadvantage is limited support outside the US — no access for international users. Additionally, Cash App limits may restrict the amount of money you can send or receive within a specified time frame, which could be inconvenient for users handling large transactions.As a balance for commission-free transfers within the Cash App system, transactions to credit, debit, and bank accounts are accompanied by commissions — from 1% to 3% of the transfer amount. It’s important to note that commission policies may change, so for the most current information, it’s best to consult Cash App’s support service.

But interest isn’t the only factor to consider. By default, Cash App transactions are visible to your friends. However, you can adjust this in the app’s privacy settings. Another limitation is the narrow selection of cryptocurrencies; Cash App currently supports only bitcoin. To address this, you might explore alternative platforms. While customer support is crucial for any product, it’s worth noting that some Cash App users have reported issues with feedback. You can find its reviews on Trustpilot.

Venmo: Social Features and Popularity

Venmo, owned by PayPal, stands out for its social aspect. This means that users can add comments and emoji to their transactions, infusing the money transfer process with a more interactive and personal touch. This feature targets a younger audience and those who value social connectivity within their financial dealings. Venmo is also widely popular in the U.S., making it a convenient choice for those who frequently transfer domestically.

| Criterion | Cash App | Venmo |

| Functions & FeeBusiness Insider | Sending and receiving money – freeCash Card (debit card) – up to 3% feeInvesting in shares to a bank account have a 1.5% fee; standard transfers – freeFiling taxesCryptocurrency support (bitcoin) | Sending and receiving money – freeUsing a credit card for payments incurs a 3% feeInstant transfers to a bank account have a fee of 1.75% (min. $0.25 / max. $25)Social aspect (comments and emojis)Popularity in the USA |

| Advantages | Integration with cryptocurrenciesFree transfers between usersSimple interface | Social interactivityWidely popular in the USAFree transfers between users |

| Flaws | Limited support outside the USFees for transfers to bank accounts | Limited support outside the USOpenness of transactions |

| StatisticsBusiness of Apps | $14.3 billion in revenue in 202355 million active users in 202322 million Cash Card owners | Processed $244 billion in total payments in 2022Estimated revenue of $935 million in 2022Over 78 million users |

However, Venmo shares a limitation with Cash App: its services are primarily available within the US, posing challenges for international users. To`one of Venmo’s drawbacks is the openness of transactions. Unless a user changes their privacy settings, their transactions can be visible to their friends or even publicly. Users must proactively adjust their privacy settings if they prefer to keep their financial activities private, addressing potential privacy concerns for those who favor discretion in their transactions.

Finalization

As digital technology progresses, the financial sector is evolving to better meet people’s needs. Financial platforms such as Cash App and Venmo are pioneering the democratization of banking. They make transactions easier and cheaper, promoting financial inclusion and empowering an increasing number of users. Looking ahead, experts from Rates anticipate these platforms will persist in their innovation, incorporating new features, and extending their global influence. This progress will provide users with increased control over their finances. However, some challenges remain, such as limited international support, privacy, and feedback issues.

When choosing a service, consider how many fees Cash App and its competitors charge. If you’re looking for a payment system with cryptocurrency support and a physical card, Cash App might be the better fit. Conversely, if you value social features and widespread popularity in the US, Venmo might be more suitable. Although making such decisions can be challenging, the advantage of democracy is the freedom to choose from a variety of service providers.

Andrej Fedek is the creator and the one-person owner of two blogs: InterCool Studio and CareersMomentum. As an experienced marketer, he is driven by turning leads into customers with White Hat SEO techniques. Besides being a boss, he is a real team player with a great sense of equality.