The insurance industry relies heavily on software solutions to manage policies, claims, billing, and other critical functions. With the right insurance software, insurers can automate manual processes, improve efficiency, and deliver better customer service. This article provides an overview of popular insurance software solutions, their key features, and their top benefits.

Insurance software solutions streamline policy management, claims handling, billing, and reinsurance operations through digital automation. They help insurers increase efficiency, accuracy, and customer satisfaction while reducing costs. Core systems like policy administration, claims management, and reinsurance tools integrate with supplemental modules for life, commercial, and billing needs. The result is faster decision-making, better compliance, and scalable growth through on-premise or SaaS deployment models.

Table of Contents

Core Insurance Software Types

Insurance software solutions are intended to implement digitalization and advancement in the most basic insurance procedures of different functional areas. These systems are put into three main categories: policy administration, claims management, and reinsurance. Each case is devoted to the automation of processes and the data-based issuing of reports for a particular area of the insurance business. On the one hand, each separate application offers a stand-alone value; on the other hand, integrated suites provide the whole process service, including a unified platform. When assessing insurance software, it is important to understand the purpose and capabilities of each type.

Policy Administration Software

Policy administration systems are the most important technical support for an insurer that can manage the entire policy life cycle from quotes to claims. Key features include:

- Customer Relationship Management (CRM) – Provides insurers with a view of customers and their interactions, including quotes, inquiries, or complaints, and allows them to provide personalized engagements.

- Rating engines – The actuarial models get very sophisticated that can calculate the risk-based prices based on the demographics, credit scores, and prior claims among others. Advanced engines allow real-time quotes.

- Underwriting rules engines – Automated policy issuance decisions using pre-configured rules assessing application data

- New business processing – Tools to assist agents inputting applications and underwriters in evaluating risks

- Renewal processing – Automate renewal notices, recurring billing, endorsement issuance and premium adjustments

- Billing and collections – Flexible premium invoicing with multiple payment options along with accounts receivable and cash management. Integrating SAP BRIM allows businesses to enhance their billing and collections, making it easier to manage flexible premium invoicing and a variety of payment options.

- Agent portals – Enable agents to initiate quotes, electronically submit applications, print policies, and manage customer accounts after issuance. While agent portals handle front-end transactions, carriers also need backend systems like Producerflow’s license compliance software to track agent licensing, appointments, and regulatory requirements across all 50 states.

Top benefits include increased new business and renewal retention, improved regulatory compliance, faster application processing and enhanced customer service. Cloud-based policy admin systems provide access from anywhere and scalability during growth peaks.

Claims Management Software

Claims systems facilitate reporting, documenting, reserving and settling insurance claims. Expanding upon core claims functions, contemporary solutions offer extensive digitization, automation and analytical capabilities:

- Omni-channel FNOL (first notice of loss) – Web, mobile, email, phone and even IoT channels to report accidents, damages or disruptions promptly

- Automatic claim creation – Real-time synced policy data inputs basic details while photo image analysis applications estimate damages

- Claims routing – Intelligent workflows distribute non-injury claims for straight-through processing while directing injury claims or potential fraud to specialized teams

- Fully digital claims file – Structured data, photos, recordings and documents provide complete evidentiary timelines

- Automated adjustment and estimation – Integrations with third-party data services enable real-time verification while machine learning programs accurately project claim amounts

- Exposures management – Dashboards relating affected policies to associated business lines, reinsurance contracts and catastrophe exposures

- Reserves automation – Predictive models dynamically calculate required reserves as claims unfold, factoring expenses and potential settlements

Automating claims processes significantly improves cycle times and accuracy while reducing expenses. Embedded analytics provides insights to boost underwriting and risk selection.

Reinsurance Software

Reinsurance systems help manage transactions with reinsurers to share underwriting risks. Contemporary solutions deliver enhanced visibility and streamlining:

- Reinsurance contract repository – Centralizes contractual agreements and amendment histories complete with reporting requirements

- Premium data warehouse – Structures rating detail at a policy transactional level to facilitate reporting by class or individual risk

- Automated reporting – User-configured bordereaux migration, removing manual compilation and submission

- Cash flow projections – Future payment expectations modeling against reinsurance recoverable

- Digital broker connectivity – Secure data access enabling brokers to view placements and claims activity as well as submit deals

- Analytics for decision support – Exposure analysis, expected loss ratios, incurred but not reported reserve impacts etc., to refine reinsurance strategy

Key advantages are a reduced total cost of risk, ensured proper cash flow timing, and data-driven reinsurance decisions. Integrations with core claims and underwriting systems also eliminate repeated data entry, allowing focus on analysis.

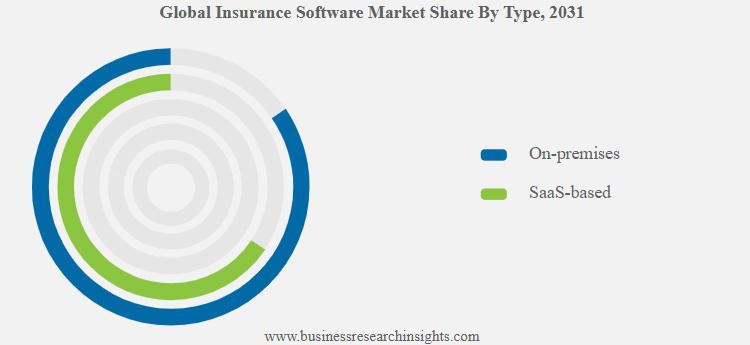

The global market is divided into On-premises and SaaS-based solutions. On-premises involve software installations and data management within an organization’s infrastructure, requiring substantial maintenance and resources. SaaS-based solutions are cloud-based, offering accessibility from anywhere with an internet connection, reducing infrastructure costs, providing automatic updates, and offering scalability, making them popular for businesses seeking flexibility and efficiency in software deployment. At the same time, regardless of the type of insurance software you need, it can be either SaaS or on-premise.

Supplemental Solutions

In addition to core systems, insurers use supplemental software tailored for specific lines of business or organizational needs, including:

Commercial Lines Software

Solutions designed for business insurance help streamline unique workflows for:

- Underwriting

- Loss control inspections

- Business owner’s policies (BOP)

- Commercial auto, property and liability

Improved risk selection and loss prevention lead to profitable growth in commercial segments.

Life and Annuity Software

Specialized capabilities for life and annuity products assist with:

- New business needs analysis and illustrations

- Optimized policy issue

- In-force policy maintenance

- Commissions management

- Product development

Insurers gain operational efficiencies while providing excellent service to life/annuity policyholders.

Insurance Billing Software

Billing systems enable more accurate, flexible and timely insurance invoices. Benefits include:

- Customizable invoice templates

- Support for installment and recurring billing

- Payment tracking against accounts receivable

- Automated reminders, past-due notices and cancellations

Insurers can improve cash flow while reducing policy cancellations due to non-payment.

Key Benefits of Insurance Software Solutions

Well-designed insurance software provides numerous operational, customer service and strategic advantages, including:

Operational Efficiency

Insurance systems automate time-consuming administrative tasks. Straight-through processing enables employee productivity gains through:

- Information capture elimination

- Error reduction

- Instant information access

- Workflow enhancements

Insurers improve loss ratios and lower operating expenses, leveraging process automation.

Superior Customer Experiences

Insurance software enables insurers to serve policyholders promptly and knowledgeably:

- Agents access comprehensive customer data, providing personalized sales and service

- Mobile apps allow policyholders to manage accounts, file claims and make payments on the go

- Online portals for insurance firms give anytime access to policy documents and billing details

- Claims status updates provide transparency to claimants

Insurers strengthen retention, providing exceptional customer experiences.

Data-driven Insights

Insurance platforms capture vast amounts of structured data which, when mined appropriately, offers valuable business insights:

- Dashboards highlight sales volumes, profitability, claims incidence and more for precise performance measurement

- Reporting spotlights areas for growth and improvement at both macro and micro levels

- Predictive analytics leverages data patterns to model outcomes, helping guide operational decisions

Insurers enhance results by applying analytical findings to strategic planning and day-to-day operations.

Product and Market Agility

Configurable software systems allow insurers to bring new products to market swiftly. Benefits include:

- Minimal IT involvement in launching product revisions

- Business user tools for building insurance products, rules and rates

- Easy integration connecting core systems with third-party data services

- Cloud deployment allows scalability to expand geographically

Insurers seize emerging opportunities and react to competitive threats, minimizing speed-to-market for new offerings.

Evaluate Your Unique Requirements

As of 2023, the size of the worldwide insurance software market was US$ 3.8 billion. The IMARC Group projects that the market will grow at a compound annual growth rate (CAGR) of 5.7% from 2024 to 2032, when it reaches US$ 6.3 billion. Some of the main factors driving the market are the growing need for insurance companies to automate software processes, the demand for mobile apps, and the increasing use of insurance software to gather data regarding claims.

While insurance software delivers substantial value, insurers must evaluate solutions matching individual requirements. Key considerations include:

- Lines of business and products supported

- Deployment options such as on-premise vs SaaS solutions

- Configurability for unique workflows and integrations

- Vendor profile, including insurance focus, stability and support capacity

- Scope of capabilities, both current and future, slated

Just as insurance policies must suit policyholders’ needs, insurance systems must address carriers’ specific situations and objectives.

Insurance technology continues advancing rapidly as solution vendors strive to meet expanding carrier demands. Insurers leveraging modern insurance software stand primed to improve customer experiences while concurrently driving operational efficiencies – the ingredients for a thriving insurance business.

Andrej Fedek is the creator and the one-person owner of two blogs: InterCool Studio and CareersMomentum. As an experienced marketer, he is driven by turning leads into customers with White Hat SEO techniques. Besides being a boss, he is a real team player with a great sense of equality.