Regardless of our race, age, religion, and background, most of us have played a game of Monopoly at least once in our lives. Well, competitive analysis is like the game (except imagine yourself playing with the pros).

Why?

Just like in Monopoly, your main aim is to focus on building your own business and maximizing your profits. But you also have to keep a close eye on what your opponents (read: competitors) are doing.

In the real world, your opponents become your competitors, and the game becomes your business. And you eventually end up doing competitive analysis to understand how to grow your own business.

In this guide, we’ll tell you all about the ins and outs of competitive analysis, how to do it comprehensively, and what its benefits are. So, let’s dig in!

Table of Contents

What is competitive analysis?

Competitive analysis is basically finding all you can about your (direct and indirect) competitors — all the good, bad, and ugly.

It allows you to understand:

- How they’ve established their market position

- What they are doing differently from you

- Areas where you can learn from them

- Mistakes you see them make that you can avoid

What are its benefits?

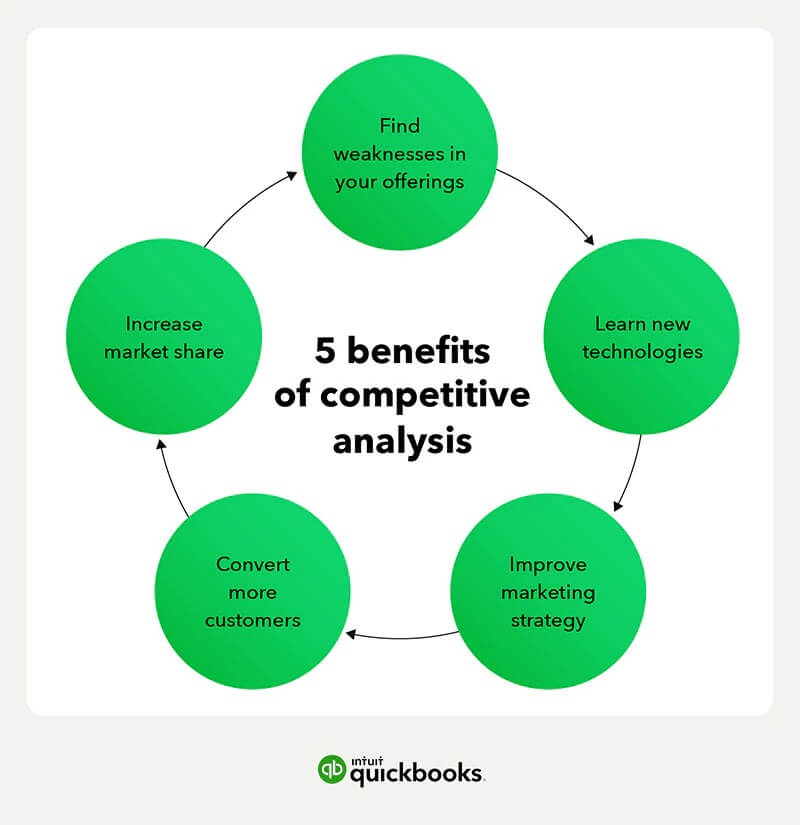

Alright, so if, at this point, you’re wondering, “Why must I do it?” then here are all the listed benefits of doing competitive analysis:

- It allows you to gauge what your competitors are offering to your target market and what’s making some of them choose your competitors over you.

- Gain insights into customer preferences, market trends, and areas of opportunity.

- It also lets you identify your own gaps and unique selling points (for example, you could realize you offer X features that your customers don’t, but you also find out there are Y features that your competitors offer and you don’t).

- Competitive research also forces you to create a plan for future growth and also provides some amount of transparency about your competitor’s pricing, customer experience, and product features.

- You understand where to allocate your resources in the future, whom to partner with, and how to adapt, keeping trends in mind.

There are many other benefits that such kind of research offers, but these seem like some of the crucial ones!

And the best part? Competitive analysis isn’t subjective to only businesses. Rather, individuals without businesses can do it, too.

For example, if you’re buying your first home, then wouldn’t you need to research a bit about other homes/homeowners in the area as well? It’s an essential step in the house-buying process.

That way, you know how much the house is worth, so you can put in a competitive offer without overpaying. And the rest, as they say, is history.

How to do it?

Follow these four simple steps to conduct a competitive market analysis.

Step 1: List your competitors

The first step on the list is to write down all your competitors’ names — be it direct or indirect.

For example, you may have a competitor that offers the same product/service as you. But you can also have other competitors whom you often compete with for search engine results page (SERP) rankings. The former are your direct competitors, while the latter are your indirect competitors.

Another example: If you’re a dog insurance company, other dog insurance companies are your direct competitors. Meanwhile, pet wellness subscription services, credit card companies with pet perks, pet tech companies, etc., are your indirect competitors.

If you’re just starting out and don’t have a thorough understanding of who your competitors are, you can do a quick online search with the primary keywords you rank for.

For example, typing something like “best pet insurance companies” in the search menu will provide you with a few names. Here’s an example of a roundup by USA Today with a helpful list of competitors in this niche:

Or, during sales calls, you can directly ask your leads about the other competitors they were thinking of considering.

Another option would be to join niche-specific communities and keep an eye out for competitor names that often pop up.

Step 2: Identify the 7Ps of their businesses

If you’re not doing competitor research with a particular niche goal in mind (e.g., marketing competitor analysis), then you can do a 360-degree comparison by analyzing your competitors using the 7Ps: product, price, people, place, promotion, process, and physical evidence.

Product: What are their product features?

If you’re doing competitive research for the first time, you’ll benefit from completely analyzing your customer’s product/service. If possible, buy their products or opt for a free trial to see the journey they take their customers on.

Some experts even suggest doing “competitor dumpster diving.” Lieu Dang, marketing project manager of Ling App, says, “This is a cheap (free) and easy way to conduct competitor market analysis.”

“Simply analyze your competitors’ public documents, such as patent filings, job postings, or press releases. These documents can reveal their strategies, new product developments, and market positioning without the need for costly market research reports.”

Other experts recommend checking sites like Twitter, Reddit, G2, Trustpilot, etc., to get raw customer insights and to completely understand what customers hate and love about your competitor’s products.

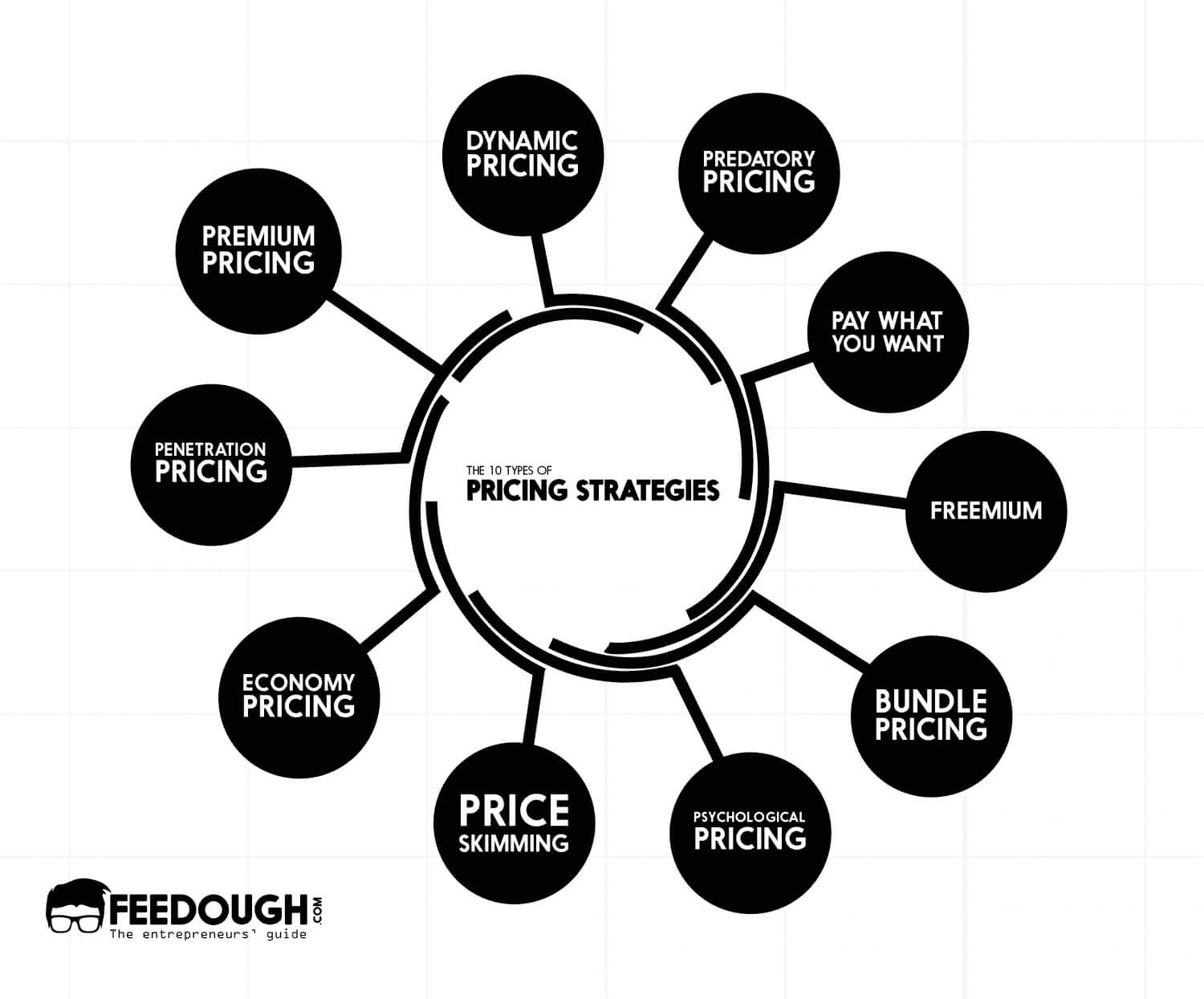

Price: How does your pricing compare?

Price is another critical factor that can make or break a deal for most customers. So, when analyzing your competitor’s pricing, find out:

- What price points do they offer? And for which types of customers?

- Is their pricing sustainable?

- What pricing model do they adhere to — subscription or one-time purchase?

- If subscription, then what features are included within each subscription tier?

- What do their customers say about their pricing? Do they find it exorbitant or affordable?

- Are your competitors overcharging or undercharging as per market rates?

- What type of pricing strategy do they use?

- Would it be possible for you to copy your competitors’ pricing? Or are you providing better value-based pricing? (All types of answers work here — you can choose to keep your current pricing, or you can either raise or decrease your pricing to match your competitor’s if you find most clients go for their business because of the prices they offer.)

People: What experience do they offer?

Next up, find out about the experiences they offer to not only customers but also to internal teams.

This data would easily be available on peer-reviewed websites, blogs that do professional reviews, and apps like Glassdoor. Or, if they offer products at a relatively low price point, consider becoming a customer to see what benefits you can reap.

Also, if at all possible, ask your current customers (who were ex-customers of your competitors) about their experiences with the company.

For example, an educational institution such as Campus.edu can easily ask its incoming batch of students who shifted from other schools what made them switch institutions, either during the interview process or through admissions essays.

However, there are cases where discerning your rivals’ target markets may be less obvious. Adopting the following strategies can prove invaluable in these cases:

- Drill down into their mission statement to decipher the groups they aspire to target.

- Closely examine the nuances of their voice and tone, as they often provide insight into their target audience.

- Look at their interactions on social networks: how they interact and with whom.

Employing these tactics can unravel the subtle threads that lead to a clearer understanding of your competitors’ target markets.

Place: What benefits do they reap because of their location?

Following the above step, compare the locations where your competitors exist. Are they on multiple social media platforms, apps like Amazon and eBay, or do they run brick-and-mortar stores?

If they’re on social media apps or Amazon/eBay, what benefits are these platforms bringing them, and does the reward outweigh the risk? If they only run a brick-and-mortar store, does this specific location present them with any benefits?

For example, some fast food chains open directly next to each other to compete based on location.

You can also go one step further and analyze how they are conducting their business operations in these places, what their display looks like, and what type of in-store experience they offer.

For example, Zara and Forever 21 may be direct competitors, but both have very different in-store vibes, product displays, and outfit collections.

Promotion: How do they stand out on social media?

Here, promotion encompasses each and everything your competitors do to shine in front of their competitors.

You can look at their social media activities, physical advertising efforts, digital advertising efforts, ads, SEO, and other activities.

Consider questions like:

- What type of content do they post on social media, and how often do they interact with their target audience? And when they do, what tone/language do they use? (e.g., Wendy’s and Five Guys are both competitors but have vastly different personas on social media).

- What type of physical advertising efforts do they invest in? Is it TV ads, events, appearances at shows, billboard ads, or anything else? Once you have answers to these questions, then analyze why they use those specific marketing channels and what possible benefits they are bringing them.

- What type of digital content have they invested in? Who are the influencers they are partnering with? Which content format has proved to be the most beneficial for them?

- What types of ads do they often invest in (e.g., display, local, video, etc.), and on which platforms — Microsoft, Amazon, or Google? What is their ad trying to convey, and what products/offers do they usually highlight in their ads?

- What does their SEO strategy look like? What types of SEO do they use, and how do they effectively utilize different types of SEO to their advantage in optimizing a website’s search engine performance? Which keywords do they rank for? What is their domain rating? What type of website content do they publish? Do they have a good linking strategy in place? Are there any unicorn keywords unnoticed by your competitors?

Pro Tip: Since analyzing every interaction might be difficult (especially if you’re analyzing many competitors at once), you can tap into augmented analytics to help you with the heavy lifting. This approach uses artificial intelligence and machine learning to generate insights, predictions, and recommendations from complex data.

By using augmented analytics, you can save time, reduce human errors, and discover hidden patterns and opportunities in your competitive market.

Process: What are their customer journeys, and what does their internal process look like?

At this stage, consider looking into the customer journeys their prospects might have (ask yourself how many client interactions they do before and after converting leads, whether their process is well laid out, and whether they have any friction in developing customer experience?).

You can find answers to these questions by checking customer reviews on online forums, asking your incoming customers, or becoming a customer yourself. You can utilize a customer service virtual assistant for all these tasks.

Other things you can analyze are what their tech stack includes, who their team leaders are, what their value proposition is, and what’s their company mission to really get into the nitty-gritty details about why they’ve taken certain steps and why their business has cultivated the image it’s known for.

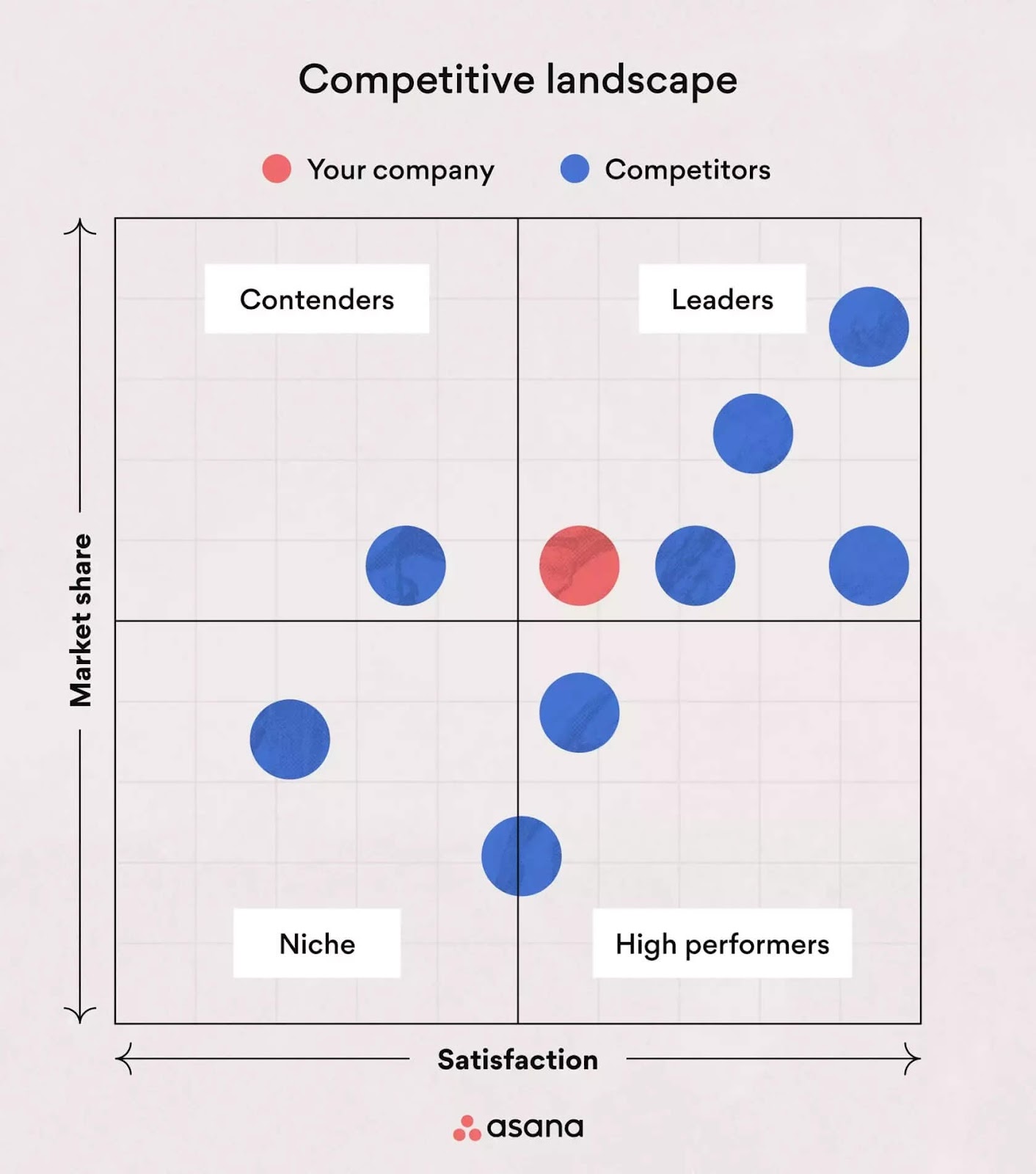

Understanding this information is key to mastering your competitive landscape and growing your customer base.

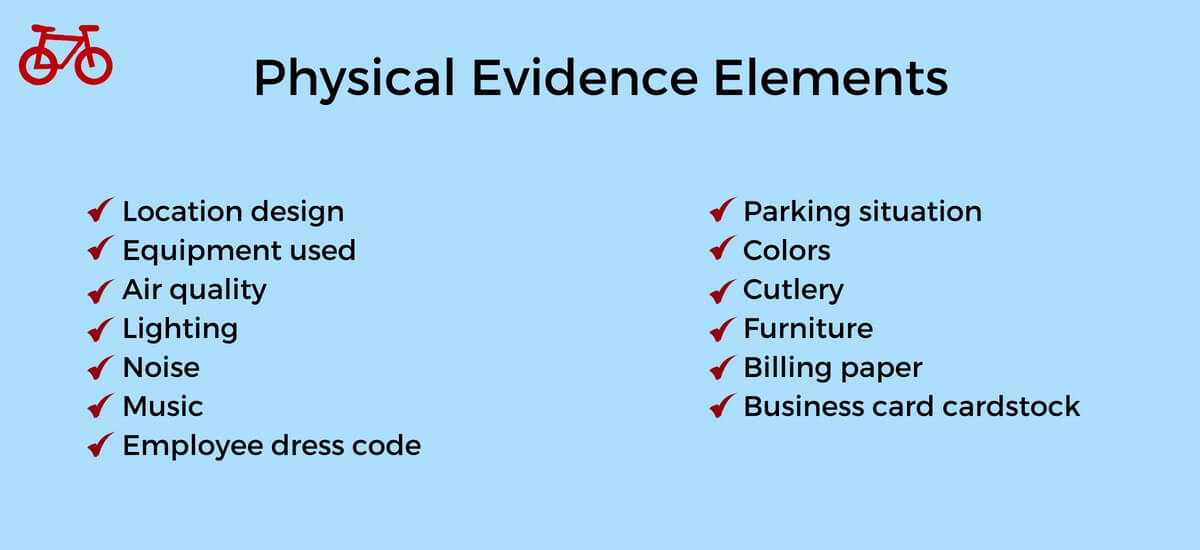

Physical evidence: What type of brand image have they cultivated?

Consider things like product packaging, company branding, brand environment, color palette, company dress codes, etc., all as a part of physical evidence, and then reflect on what brand image this overall effort cultivates.

Is this image nice, and would you like to replicate it? Or do you find flaws in it, and would you like to notice their mistakes and possibly consider a brand refresh?

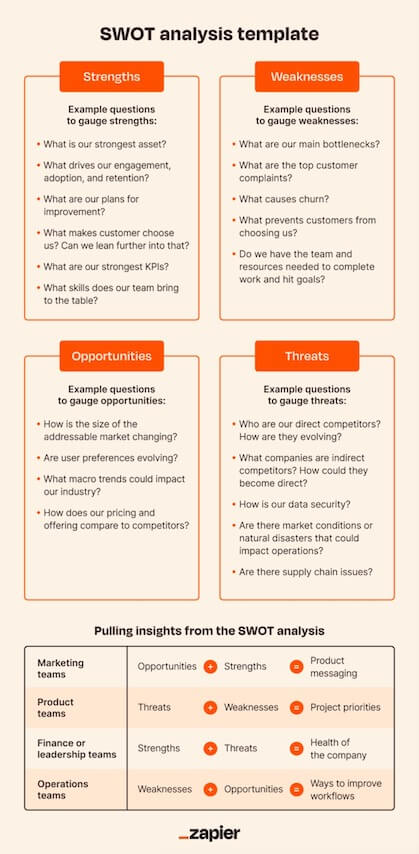

Step 3: Do a SWOT analysis

After you’ve gone through the whole nine yards of completely analyzing your competitors, now comes the time to tackle the meatier bits by performing a SWOT (strengths, weaknesses, opportunities, and threats) analysis.

At the end of the day, this analysis will help you directly note down:

- The opportunities you could bank on.

- The threats you should be aware of from your direct competitors.

- The strengths your business has to fight these threats.

- The weaknesses it has that can affect it later down the line.

Step 4: Strategize

Finally, once you have noted down everything of importance, now comes the time to sit down, put your precious mind to work, and strategize about:

- Where are you going to allocate your resources?

- How are you going to move forward?

- What opportunities will you prioritize?

- What will you do to remove the threats?

- Which strengths do you need to double down on?

- What should you do about the weaknesses you have?

- Who (i.e., which team members) will help you through the execution?

- Within which timeline do you expect to see an improvement?

- How will you incorporate this information into your marketing strategy?

Juwaria is a freelance writer specializing in the fields of SaaS, marketing, and health/wellness. Backed with 3+ years of experience, she helps brands build content that adds value to their business. In her free time, you can catch her reading her favorite books or studying the latest trends online.